Merely Competent Mobile Games Are Not Good Enough Anymore

When future historians come to chronicle the mobile revolution and the emergence of the apps economy, it doesn’t take a rocket scientist to realize that mobile games will play a starring role.

Mobile games dominate both of the app stores. This is not only an established fact but also an acknowledgment that the status quo is unlikely to change anytime soon. To put it another way, mobile games are one of the reasons why the apps economy is an earnings juggernaut. Perhaps the only reason, if we take out the outliers like Facebook’s family of apps, Google’s constellation and Snapchat.

A report by Sensor Tower said global gross revenue from mobile games in the first quarter of 2017 was around $11.9 billion—a year-on-year increase of 53%. The App Store took more than half of gross revenue, with publishers earning around $6.6 billion in revenue in Q1 2017.

Global mobile game installs over both app stores totaled 8.8 billion, a year-on-year increase of 15%.

Most Mobile Games Are Zombies

And if further proof were needed that the global app ecosystem is driven by mobile games, Sensor Tower said that 80% of the App Store’s gross revenue in the first quarter of this year was game-related. On Google Play, mobile games accounted for 91% of gross revenue. When you consider that people spent $41 billion on mobile games in 2016, then it is clear that you don’t need a console to be a gamer.

Out of the 2.3 million active applications in the App Store, 771,921 are mobile games, according to Pocket Gamer. In the month of March alone, developers submitted 3,642 “new” games to the App Store—an average of 117 games every day. A similar number arrived on Google Play. Most of these games will likely never get played.

Mobile games have a hierarchy that mirrors the rest of the app ecosystem. Premium or popular titles will generate revenue and installs while the majority of games will fester in the equivalent of app store purgatory (the “zombie” app store). At the same time, developers face a constant battle to get their games in front of the people that matter … the gamers themselves.

Quantity Is No Guarantee Of Quality In Mobile Games

According to Boston-based indie game developer and founder of Dejobaan Games Ichiro Lambe, the billions of dollars in generated revenue glosses over the simple truth that most games are not worth repeat visits.

“There are very few remarkable games out there, ones that you might actually want to play,” said Lambe. “You come to the realization that 90% of everything is crap … or in this case, 90% of everything is merely competent. That is not good enough anymore.”

Lambe believes that the hundreds of thousands of games available are actually diluting the pool for people that want a quality gaming experience. Consumers are fickle, demanding and cheap, Lambe said. This scenario makes it even more difficult for developers to deliver a well-polished game experience that resonates with both casual and hardcore gamers.

Games that can be considered as “blockbusters” are in short supply. When you take into account that successful mobile games follow the well-trodden path of the freemium model—offer the game for free, get people hooked, hit them with micro-transactions to increase gameplay—then the rude health of the mobile game ecosystem can be questioned.

In 2016, the top five grossing mobile games in the United States were responsible for 28% of all earned revenue, Pocket Gamer reported. Games such as Clash Royale and Mobile Strike continue to rank up impressive revenue figures, with the former breaking through the $1 billion in lifetime gross revenue, according to Sensor Tower’s quarterly report. Both of these mobile games have benefited from a major advertising blitz and would certainly fit into the blockbuster category.

As is the norm, blockbuster status comes at a price.

For example, Nintendo’s Super Mario Run relies on a significant financial outlay—just under $10 to unlock the whole game—to attract gamers. On the plus side, the up-front payment does remove the irritating in-app payment aspect but the game is the exception to the freemium rule and unlikely to become the norm going forward.

The challenge for game developers, according to Lambe, is not to emulate the top mobile games or take on the major publishers, but to take advantage of the tools available.

Game development platforms like Unity or Unreal Engine are widely used and have (in theory) narrowed the gap between large studios and indie developers. Both of these platforms provide developers with everything they need to build a polished experience that can hold its own among the titles with bigger budgets and large development teams.

“Small studios are best when they don’t take on big studios head-to-head,” said Lambe. “I am not going to build a realistic first-person-shooter ever, but I can do a stylistic one or some other experience that blows people’s minds.”

With that in mind, the future of mobile games may rest on delivering new experiences and games that are not merely competent. The mobile game industry has been an unqualified success since day one, but its continued ability to generate revenue is solely predicated on what gamers want to play. And that is always an inexact science.

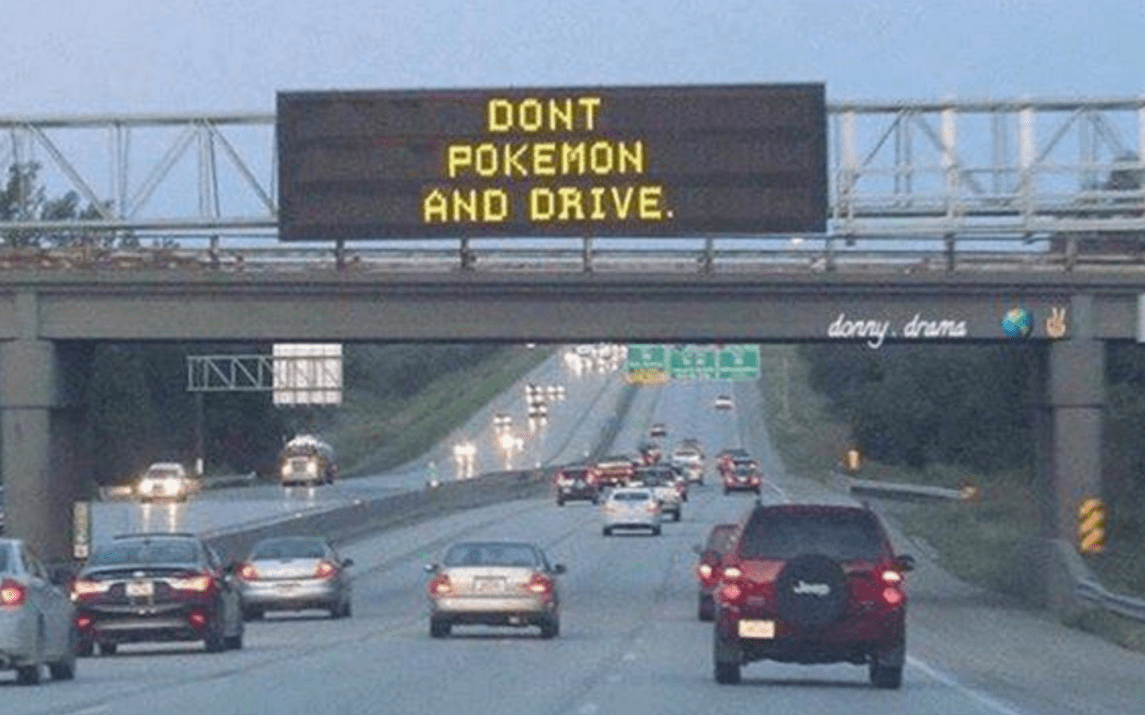

“For all of its faults, Pokemon Go brought a lot of people together … it was step one,” Lambe said. “What is the step before things become awesome? They are crude and then they become better. Pokemon Go could very well be the catalyst for the next generation of gaming.”